Benefits for Canadians

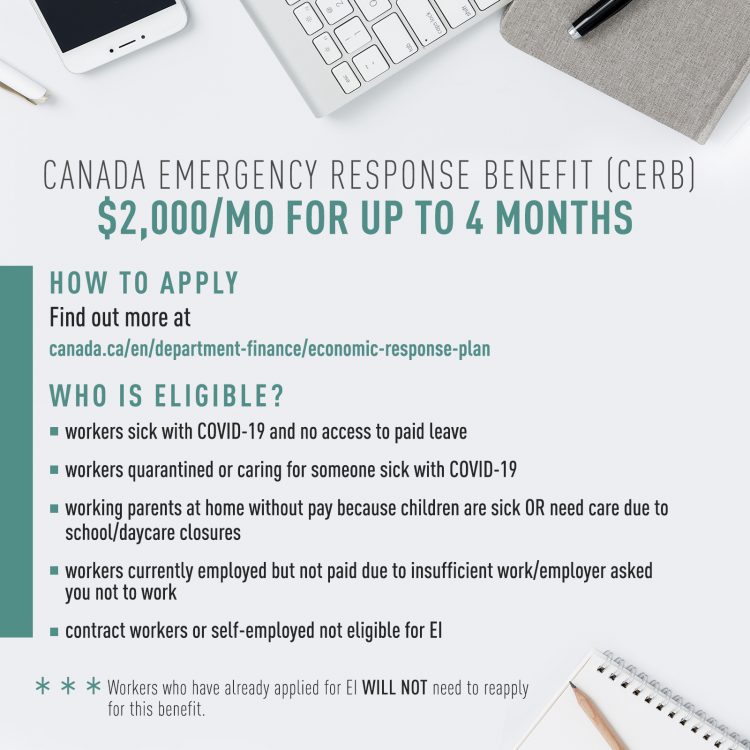

Canada Emergency Response Benefit

The Canada Emergency Response Benefit (CERB) provides emergency support of $2000 a month for Canadians affected by the COVID-19 emergency.

Remember: the way the government set up CERB you need to reapply every 4 weeks.

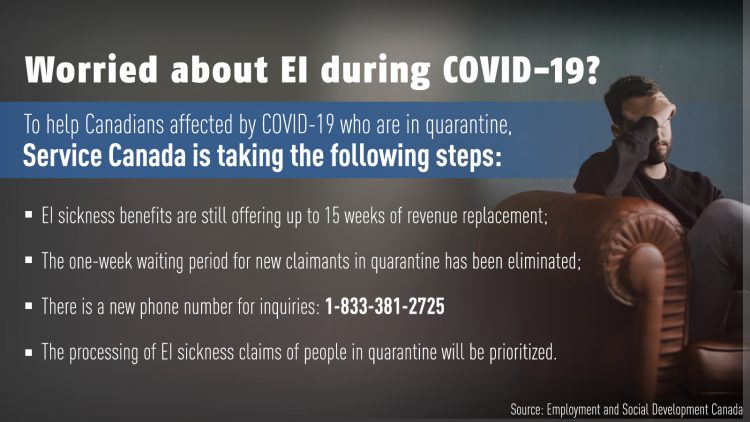

Employment Insurance

Employment Insurance (EI) remains available for Canadians.

If you are sick or your employment has been affected by COVID-19 and you qualify for EI you can apply below.

- Waived the one-week waiting period for EI benefits.

- Waived doctor’s note requirement to access EI sick benefits.

For more information visit their website or contact EI’s COVID-19 phone line at (833) 381-2725.

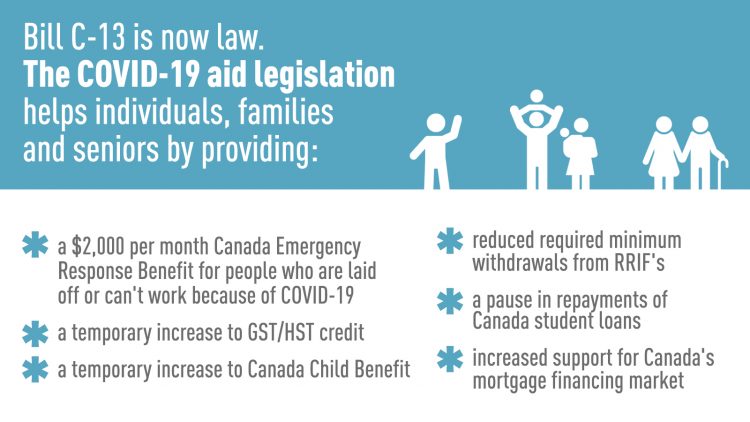

Tax and benefit changes to help Canadians

- An increased Goods and Services Tax credit (GST) payment.

Average additional benefit will be near $400 for individuals and near $600 for couples. No need to apply eligible individuals will receive the benefit automatically. - Increase to the maximum annual Canada Child Benefit (CCB) payment amounts, by $300 per child.

- Tax return date is deferred until June 1.

- Payment for taxes owed is deferred till August 31.

- Interest-free moratorium on the repayment of Canada Student Loans until September 30, 2020.

Support for businesses

- We Conservatives pushed for more support for workers and now businesses in need will receive a wage subsidy equal to 75% of wages paid during the emergency period. That’s up from the original 10% the government proposed.

- The proposed the Canada Emergency Commercial Rent Assistance (CECRA) will offer support for 75% of commercial rent for eligible small businesses.

- Working Capital Loan and the Business Credit Availability Program (BCAP) available through the Business Development Bank and and Export Development Canada (EDC).to help support entrepreneurs during the crisis.

- Deferral of Sales Tax remittance and customs duty to June 30, 2020. This is applicable to businesses, including self-employed individuals, on the GST/HST as well as customs duties owing on their imports.

Support for farmers

- Increasing Farm Credit Canada by an additional $5 billion in lending capacity to farmers and food processors. This will help them bridge cash flow issues during this emergency.

Support for students

The proposed Canada Emergency Student Benefit (CESB) would provide $1,250 per month for eligible students who aren’t eligible for the Canada Emergency Response Benefit or Employment Insurance or unable to work due to COVID-19.

We Conservatives are also calling for a program that matches students looking for work with essential jobs in agriculture.

Farmers across Canada need workers and students need jobs.

This is a win-win policy that helps students, farmers and maintain the security of our food supply.

![]()

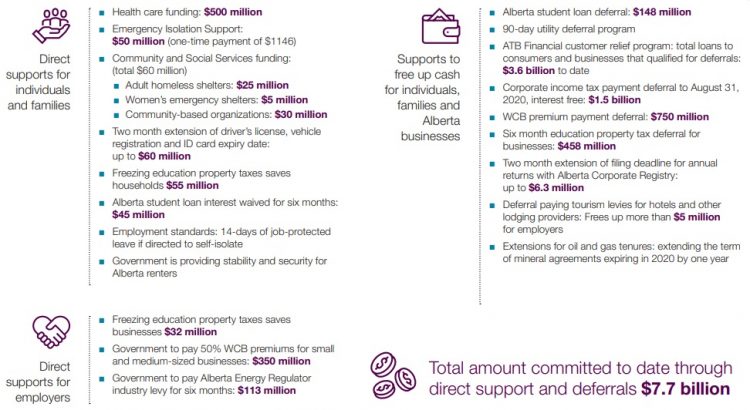

Assistance programs offered from the Government of Alberta

- Utility payment holiday:

Residential, farm, and small commercial customers can defer bill payments for the next 90 days. This will cover electricity and natural gas, regardless of the service provider. Call your utility provider directly to arrange for a 90-day deferral on all payments.

- Provincial student loan holiday:

Six-month interest-free moratorium on Alberta student loan payments.

- Emergency credit and mortgage deferrals:

Emergency deferrals are available for ATB loans, lines of credit and mortgages for up to six months. Contact the ATB, bank or credit union to work out a plan for your personal situation - Education property tax freeze:

Residential education property tax rates will be frozen at last year’s level.